Of course all of this is mainly political rhetoric at the start of what is set to be an election year, but still, it does raise interesting questions. Where exactly is Spain? What is the outlook for the future? Is the country still in crisis, or is it, as Rajoy 2.0 suggests simply suffering from the legacy of an earlier one? These questions are not as easy to answer as they seem at first sight, nonetheless in what follows I will take a shot at it.

Questions to be discussed below are:

- has enough been done in terms of international competitiveness to be able to guarantee a "complete" labour market recovery?

- to what extent is Spain's housing market really going to recover?

- is the external correction complete, or is there more to do?

- Spain's population (and especially it's working age population) is in decline, what are the economic implications of this? And what is the long run growth outlook for Spain?

- the cost of paying pensioners continues to grow more rapidly than income from contributors - does Spain need another pension reform.

- Spain's economy will grow comparatively quickly in 2015, but the ECB is buying Spain government bonds, ECB interest rates are near zero, and the country is running the largest fiscal deficit in the EU. What would Spanish growth look like without the deficit and with a "normalisation" of interest rates?

- Spain's sovereign debt is about to pass the 100% of GDP level, will the next government be able to stabilise the debt, or will it continue to grow?

- Spain's recovery at present is largely a services and domestic consumption based one. Industry and capital expenditure continue to lag behind. Is this profile sustainable in the longer term?

Spain's "Good" Deflation?

Why Is Spain's Population Loss An Economic Problem?

Spain - Fuelling Today's Retail Sales By Spending Tomorrow's Pensions?

Spain's Recovery Is Real

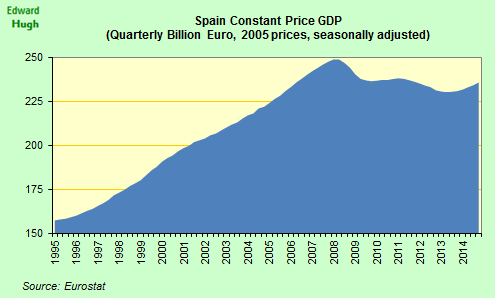

The most striking and obvious thing about the Spanish recovery is the way in which real (inflation adjusted) GDP growth rates have steadily accelerated. The country's economy - with a quarterly increase of 0.8% -had one of the fastest growing Euro Area economies in the first three months of 2015. The annual rate accelerated to 2.5%, while full year 2014 growth rate (as compared to 2013, when it shrank by 1.2%) was 1.4%.These are good results, but it is worth bearing in mind that everything is relative and that there is still a long hard road to travel. GDP levels still remain around 4.5% below the pre-crisis level. And while the (possibly optimistic) Bank of Spain forecasts are for robust growth in the near future - 2.8% in 2015 and 2.7% in 2016 - even their achievement will mean the pre-crisis level will not be attained before 2017, which gives a very concrete and precise meaning to the term "lost decade". The real debate is about the following decade, whether or not that one will be lost too, as deflation and secular stagnation steadily take hold in the context of an ageing and declining population (see the latest IMF report on this, and Larry Summers on Secular Stagnation here) . Is Spain not at risk of becoming Japan 2.0?

Certainly there are many in Spain who would deny that possibility, among them Economy Minister Luis De Guindos, who recently told the Wall Street Journal that he expected growth of between 2.5% and 3% for the next two to three years with the trend simply continuing thereafter. Bank of Spain governor Luis Maria Linde would be another. He recently told Bloomberg reporters that negative interest rates would be a temporary phenomenon which would disappear as the "recovery tales hold" and that it was much easier to "assert there was no deflation risk" in Spain than it had been some months earlier (when he was also saying there was no risk). Such assertions are hard to either agree with or dispute, since no one really knows the future. Words are easy while economic models simply mindlessly churn out predictions based on past performance. The only thing we can be sure at this point is that the future will look less like the past than it ever did, so forecasts based on old data have less validity than ever. At the same time simple economic theory suggests that as work forces decline economic growth rates will do too.

Still, were the most optimistic forecasts to be confirmed the resulting growth rates over a sustained period would clearly turn the country into the Euro Area's most efficient and fastest growing economy, and it is hard to see where the basis for such confidence comes from. When Spain's economy grew at rates of 3% or more a decade or so ago it was on the back of excessive and unsustainable debt increases, and that isn't going to happen again, even were it desirable. Spain's economy may well grow by more than 2.5% this year (although with deflation nominal GDP will grow by less), but - failing something unexpected like Grexit - it is hard to imagine a more positive growth environment. As for when we get to 2016, as they say, it depends.........

Employment Growth Is Strong As Unemployment Falls

The second area where it is possible to see a strong positive side to Spain's recent performance is on the employment front.According to the latest labour force survey Spain created 434,000 jobs in 2014.To put some flesh on these numbers it should be said that many of the new jobs are part time (40% of new indefinite contracts are p-t), while many others are temporary and not well paid (the economy is increasingly becoming a low value added services one, lead by tourism), but still, Spain's economy is once more creating employment, and that is good news.

A similar picture emerges when it comes to unemployment which is now steadily falling back, with the seasonally adjusted rate falling to 23.2% in February.

And the positive news continued in March: registered signings fell by 7.17% year on year.

A similar picture emerges from the data for affiliations to the country's national insurance system, which were up 416,000 (or 2.3%) in 2014.

In fact - as can be seen in the following chart showing numbers of social insurance affiliates - the rate of job creation continues to accelerate.

And this better employment situation is also confirmed by the fact that the economically active population rose in the last three months of 2014, although it was down over the previous December by 44,000. The participation rate rose from 58.03% in Q3 to 58.24% during the last quarter.

Naturally, putting all this in perspective, the number of unemployed - almost 5.5 million - remains unacceptably high, and the increase in employment needs to be seen in the context of more than 3 million jobs having been lost since the start of the crisis, but still, things are manifestly improving.

Consumer Confidence Hits A Record High in March

Household Consumption Driving Recovery

As employment has risen and real (inflation adjusted) wages and pensions have increased (since consumer prices have fallen) spending has naturally rebounded: indeed we seem to be in the midst of a mini consumption boom driven by what is perceived as a short term reduction in prices (which look to many shoppers like very welcome discount offers).According to the National Statisics Office retail sales rose (in price adjusted terms) by 1% in 2014 as compared with 2013. I stress price adjusted since with consumer falling an annual 1.1% in December and 0.2% across the year the actually increase in cash in the till was less. Perhaps such an increase is not a game-changer, but after a 30% drop any improvement is welcome.However 2015 sales did not start on such a strong footing, with retail sales falling for a second month in Feb. They were down 0.7% vs Jan (when down 0.4% vs Dec). Still due to the strong autumn surge they were still up 2.6% y-o-y.

Household consumption - which includes a broader range of spending than retail sales, including the government subsidized car sales - had a very strong 2014, and was up 3.9%. It is not clear that this pace can be repeated in 2015, especially if inflation starts to rebound following the Euro devaluation.

Construction Activity Growing Again

Construction activity has also been rising. Output was up 14.4% year on year in January. Quite what is driving this isn't clear, since with a large stock of unsold houses the demand for more at this point (see below) must be limited, but surely there is activity involved in completing unfinished buildings, of which there are more than a few. Again, this is (in theory) election year so infrastructure spending is probably increasing.Well again, peak to trough was something like 60%, so the rebound could have been anticipated.IBEX on a Roll?

The financial sector has been one of the principal beneficiaries of the Spanish recovery, thanks largely to the hard work of Mario Draghi at the ECB. Many will remember the immortal words of the late Emilio Botín: "Es un momento fantástico para España, llega dinero de todas partes." ("This is a fantastic moment for Spain, it is literally raining money from all corners of the globe" October 2013). As a result the IBEX had a very good 12 months from July 2013 to July 2014 (up maybe 35%) but in the second half of last year struggled to stay over the 10,000 level. QE from the ECB will likely be a positive for the index in 2015.

Negative Bond Yields Arrive

The Draghi QE effect has long been making itself felt right across the Euro periphery, and Spain's bond yields are now constantly breaking historic lows. The 10 year yield has more than halved over the the last 12 months and is now at 1.39% (and falling). Naturally these lower yields will make government interest payments lower (and indeed due to seigniorage repayment will even become zero on those bonds purchased as part of the ECB programme). This benefits everyone, but beyond this the IBEX boom and the increase in bond values which accompanies the drop in yields has made a lot of money for some people, even though these people are a small minority of the Spanish population (indeed they have often been external investors). This means on the one hand that the Spanish net external debt has risen, while on the other those who have suffered most during the crisis feel even more aggrieved that they have been left out of this particular party (the Podemos effect).It's possible every time Mariano Rajoy opens his mouth to declare "victory" he probably only ends up alienating yet another group of people who feel they are missing out on the "good times". Certainly this is what the government opinion surveys suggest. In March 41.8% of those asked thought the economic situation was "bad", and 33.8% thought it "very bad", while only 1.8% replied it was "good", and 21.6% "passable". So I think it is reasonable to say that ordinary Spanish citizens do not buy the very bullish arguments being offered by the government at this point, and this is also being reflected in the opinion polls. As most political observers note, economic recovery should help the PP, but first the PP have to convince a skeptical populous that this recovery is real, and that talk about it is not simply another attempt to lead them up the garden path.

Now For The Glass Half Empty Part

How "Good" is Spain's Deflation?

In my opinion deflation is one of the serious problems potentially clouding the economic outlook in Spain, as I explain in my Spain's "Good" Deflation post. Since I have gone through all the arguments in great detail there I won't repeat myself here.I would just note that the argument that Spain is simply suffering the impact of a negative oil price shock doesn't hold up, since as the chart below suggests, once you strip out tax impacts and energy, Spain has been flirting with deflation since the start of 2012.

It is also clear that there is no short term purchase postponement effect, in fact we can see evidence across countries that as prices fall people buy more. This is largely because they do not expect deflation, and simply take advantage of what they see as "temporary" sales offers and discounts to buy. As very low to negative inflation extends across time the risk is that people come to expect constant and renewed discounts, forcing prices even further down. This is the short term self-reinforcing component.

It is also the case that up to now prices have fallen, but wages and pensions have not been reduced proportionally. If and when this starts happening the impact on consumer confidence may be the opposite of the one we are now seeing.

In general, as long as incomes don't fall the growing debt burden problem isn't operative, since debt to income levels don't change, it's only as incomes fall, and over extended periods of time, that this impact starts to make its presence felt.

Is There a Recovery In The Housing Market?

Spanish housing offers us a clear example of something whose price has fallen considerably, around 40% since the 2007 peak, and whose price continues to fall (in the 3% to 5% per annum range).Yet far from this fall in prices having stimulated demand we are witnessing the opposite effect: demand has collapsed, and is not recovering significantly (see my piece from April 2014, "Firmly Anchored Expectations, No Postponement of Purchases?"). The number of new house purchased in December was just over 7,000. That was the lowest monthly level in more than a decade.

True, the number of second hand houses is rising, but even the combined total is far from showing a sharp rebound.

Perhaps the most worrying thing about the fact that second hand purchases are improving while new ones aren't is that part of the explanation for this is that properties become reclassified as "used" 2 years after completion (so some of the second hand houses are in fact new), but this makes the situation with new houses deeply preoccupying since there are nearly half a million unsold housing units still classified as "new" (see this article on the Spanish property website Idealista) which means they have - by and large - been built within the last two years. According to the construction manufacturers association Cepco the number of new housing units which had been neither sold nor let at the end of 2014 stood at 439,617.

The housing market is obviously stabilizing but that is not the same thing as returning to real growth, especially as far as house prices are concerned. There are two reasons for thinking that the recovery will be very weak. The first of these is the growing custom among young people to rent rather than buy. But the second is even more important: Spain's population, especially in the 25-40 age group is falling and each generation is now smaller than the previous one.

From an Export Lead to an Imports Driven Recovery?

Exports went through a "soft spot" in the middle of 2014, but recovered towards the end of the year. Price deflated goods exports were up 4.7% in the year to December in comparison with the same period in the previous year. Deflation in Spain (export prices were down an annual 1.1% over the same period) and the weakening Euro are obviously helping. Tourism is also doing well, and income from this activity rose by about 3.4% in the year to January (when compared with the previous 12 months).Nonetheless, it is no longer true to speak of Spain's recovery as "export driven" since the growth in domestic consumption has lead to a surge in imports, and the goods trade balance has weakened accordingly, meaning that when it comes to GDP levels net trade is now a negative factor (see below). This issue will come back to haunt us, since with the population falling, the government reducing the fiscal deficit and the private sector not increasing its appetite for credit domestic demand cannot continue to drive the economy indefinitely.

External Balances Worsening?

While external demand had been making a positive contribution to Spanish economic growth from early 2010, the second quarter of 2013 saw a major shift, with net trade becoming negative, at the same time as domestic demand became a positive factor. Thus the recent recovery is almost entirely due to growth in domestic demand (and growing imports) despite the fact that exports have held up well, and continue to grow to new highs.The level of Spanish exports is constantly higher, but exports only contribute to GDP growth insofar as they grow, and this rate has been falling steadily since the post crisis peak. As such the contribution of exports to growth becomes less and less.

On the other hand the current account balance, after deteriorating in 2013/14 has been improving since mid 2014 thanks largely to the drop in oil price and the impact of the falling Euro on income Spanish residents (including corporates) derive from their non-Euro overseas holdings (USD investments are worth more in Euros after the devaluation).

However the fund inflow that has accompanied the boom in Spanish bonds and stocks has meant that the net external debt balance has again deteriorated. In fact the Net International Investment Position now stands at nearly 100% of GDP negative. This is not a good development, or sustainable. Spain cannot both deleverage and have positive net fund inflows. The long term numbers don't add up. In the short run the inflows are financing the government's fiscal deficit.

But since interest rates are lower in Europe than in many other parts of the world, the net income stream has actually improved since foreign investors earn relatively little on their Spanish asset holdings, and mainly are benefiting from capital gains. Nonetheless Spain has clearly made a massive improvement in its current account balance which is a big positive for the economy.

Industrial Output Lags Behind GDP

Spain's economic recovery is no longer export lead, and it isn't industry based either. Industrial output, as can be seen from the chart, has hardly budged since the return to growth began, and was only up 0.6% compared with a year earlier in February. To get a sustainable recovery Spain needs industrial (and not just services) growth.And Let's Not Forget the Fiscal Deficit

Spain's leaders are very proud of the country's recent growth performance, they also like to claim that it is largely due to their ongoing austerity policy. What they don't mention so often is that the country ran the largest fiscal deficit in the EU in 2014 (5.7% of GDP) and will do the same in 2015 (around 4.5% of GDP). In fact Spain's deficit objectives have been relaxed a number of times in recent years, so far from the outcome being a victory for austerity it is more like a victory for leaving extra stimulus.Between falling prices, high fiscal deficit, ultra low interest rates and strong external fund inflows it would be surprising if Spain weren't doing well at the moment. A bigger test will come as all these positive tailwinds start to change direction. Spain probably be running a primary (before interest payments) budget surplus before 2017 - Greece, it will be remembered, is being asked to run one of between 3% and 4% of GDP. If Spain does eventually manage to run a primary surplus it will indeed be interesting to see what the growth rate is. In the meantime the sovereign debt level will pass 100% of GDP this year, and will continue to increase.

Economic Consequences of Demographic Decline

The Price Of Doing Nothing

The social and political risks associated with Spain having conducted a far from complete economic adjustment are now becoming apparent, but there are also long term economic consequences, ones which may not be very evident at this point. People are often too busy celebrating a short term return to growth to ask themselves the tricky question of where all this is leading.

The most obvious result of having such a high level of unemployment over such a long period of time - Spain's overall rate won't be below 20% before 2017 at the earliest - is that people are steadily leaving the country in search of better opportunities elsewhere. Initially this new development was officially denied, and since there is little policy interest in the topic we still don't have any adequate measure of just how many young educated Spaniards are now working outside their home country. Anecdotal evidence, however, backs the idea that the number is large and the phenomenon widespread. All too often articles in the popular press are misleading simply because journalists have no better data to work from than anyone else. On the other hand work like this from researchers at the Bank of Spain (Spain: From (massive) immigration to (vast) emigration? - 2013) only serves to illustrate how little we know, especially about movement among Spanish nationals.

On the other hand, when it comes to migration flows among non Spanish nationals we do have a lot better quality information due to the existence of the the municipal register electronic database. Everyone who wishes to be included in the health system needs to register with it (whether they are a regular or an irregular immigrant), and non Spanish nationals need to re-register with a certain frequency (so the authorities know if they leave). For a fuller discussion of the economic issues raised by Spain's population decline see my post "Why Is Spain's Population Loss An Economic Problem".

Current Level of Pensions Not Sustainable

The average pension paid is also rising. In February 2015 the total amount paid out by the system in pensions was up 3.1% year on year. But the number of pensioners was only up 1.3%, so the average pension went up by 2.1% due to the fact that the most recent retirees have been earning more than earlier cohorts and are thus entitled to higher pensions. We don't have data on this year's pension system income yet, but at the end of last year it was rising at about 1.5% a year, leaving a growing shortfall for the system to cover.As I said, under the former PSOE the shortfall was funded out of the general government budget, and possibly 1.5 percentage points of the 9.6% 2011 fiscal deficit were the result of this financing. With the arrival of the PP in government this policy changed, and pension financing moved over to the Reserve Fund.

The attrition has been constant and the Fund is now starting to dwindle. In 2012 7 billion euros were withdrawn, in 2013 it was 11.6 billion euros and in 2014 15.3 billion euros (or 1.5% of GDP). If you want to compare apples with apples and pears with pears, you would need to add this 1.5% of GDP to the 5.6% fiscal deficit, giving a 7.1% deficit using the same accounting criteria as 2011. Put another way the deficit has really been reduced from 9.6% to 7.1% in 3 years, hardly dramatic austerity. Instead of paying the pensions gap out of current income the government are using a credit card issued by "future pensions" to keep payments up even though the situation is obviously getting worse, meaning it will be even more difficult to pay current pension levels in the future than it is As a result of all these withdrawals the size of the Reserve Fund has fallen from its 66.8 billion euro peak in 2011 to the current level of 41.6 billion euros. At the moment the government have budgeted for another 8.4 billion euro withdrawal this year, but this number could easily turn out to be larger. So 2015 should close with around 30 billion euros outstanding - about 3 years more money at the current rate. It is clear that soon after the election changes will have to be made. Even though the number of contributors to the system is growing as the employment situation improves the rate of spending is rising faster.

Financial Sector Deleveraging or Less Solvent Demand for Credit?

Mario Draghi understands that falling inflation expectations raise real interest rates by influencing the perceived cost of credit into the future. If consumers anticipate inflation, then that makes borrowing cheaper and people tend to advance purchases. Conversely expected price falls make the cost of borrowing greater, make the desirability of advancing purchases via credit less, and in this sense constitute monetary tightening. I am aware of an ongoing debate about whether interest rates really are a key factor influencing investment decisions, but I have never seen an argument suggesting that the cost of credit does not influence consumption. And so it is in Spain, since the demand for household borrowing is not surging, even though the country's banks keep telling us they are now "ready to lend".

I am aware of an ongoing debate about whether interest rates really are a key factor influencing investment decisions, but I have never seen an argument suggesting that the cost of credit does not influence consumption. And so it is in Spain, since the demand for household borrowing is not surging, even though the country's banks keep telling us they are now "ready to lend".

In fact lending is still falling, and was down an annual 3.2% to the private sector in February. There may be many reasons beyond the strength of bank balance sheets which may explain why we are not seeing an increase in private sector credit in Spain. Some may simply not be able to get loans because they already can't pay their existing debt. The 4 million Spaniards currently on the credit blacklist run by credit consulting firm ASNEF will have a hard time joining in the current consumer "boom" even if they have a job. Spain's Economy minister Luis De Guindos put quite graphically when he said: "It’s hard not to defer purchases when you’ve got no money for them in the first place. In the case of Spanish unemployed I think they’ve got more worries than waiting for a new sofa suite to drop by €50."

So part of the reason for the "no credit expansion" is the high level of existing debt and the large number of unemployed or people working in low pay short-term contract jobs. Many corporates are also still heavily indebted, and those that aren't are still facing comparatively low levels of demand for their products, which means they will not be engaging in large scale investment projects, which anyway they would probably finance via the bond markets.

Political Uncertainty Ahead

When the IMF said last year that Spain's unemployment level was unacceptably high, I was pretty critical of the fact that they didn't spell out the consequences of this, or offer any substantial policy alternative. The most obvious impact of this failure to find an alternative is being seen right now, with the emergence of political movements which could well turn the country's two party system completely upside down, and the steady flow of talented young people out of the country in search of work.According to the latest Metroscopia opinion poll carried out for the newspaper El País ( April 12 2015), four parties (Podemos 22.1%, PSOE 21.9%, PP 20.8%, and Ciudadanos 19.4%) are in close competition for first place in the forthcoming election. The lastest arrival on the national political scene is Citizens (Ciudadanos), a movement which despite being difficult to pin down in terms of specific policy, seems to lie somewhere to the centre right, between PP and PSOE in terms of its political ideology. It is very hard to predict what the outcome of the coming general election (due at the end of this year) will be, but it seems clear that no one party will have a majority. So governmental arithmentic is about to get complicated.

The first indication of what the political landscape might start to look like should come in Andalusia, which has regional elections on March 22. Then in May there will be regional elections in Madrid and Valencia, and municipal ones in large cities like Madrid, Valencia and Barcelona. Such elections will, however, only give a vague impression, since personality factors and local loyalties will also be important.

As for the concerns which are driving this earthquake, these are clear enough from the opinion surveys: unemployment, corruption and the issues related to their current economic situation are by a long way the most important issues in voters minds, indeed despite all the talk of recovery the vast majority of them continue to think the current economic situation is either bad (41.8%), or very bad (33.8%).

Forthcoming alliances are hard to predict. Ideologically Podemos and Citizens may seem far apart, but the voter concerns which are driving their rise are often surprisingly similar, even if the solutions they offer are quite different. Over the corruption issue, for example, the possibility must exist of a de facto alliance between the two movements to force major reform on the two "traditional" parties.

Another issue which will probably unite them is that of debt. Many of Spain's citizens are badly indebted, and many still have difficulty paying their mortgages despite very low interest rates. In addition there is the notorious "full recourse" rule, which means people who can't pay can't simply return their home and liquidate their debt. There is a wide feeling of injustice associated with the fact that property developers received limited liability mortgages (many of which have now ended up with bad bank Sareb, with losses being met by taxpayers) while ordinary citizens were given no such "escape clause". "Rescue the citizens not just the banks," is a slogan you often hear these days.

It is unclear what Citizens propose to do about the issue, but Podemos's opinion is clear enough, and on this stance they enjoy widespread popular support, going well beyond those who will actually vote for them: they will revoke full recourse. It's not a mere detail that the point Pablo Isglesias stressed in his interview with CNBC's Michelle Caruso-Cabrera was, "we can have governments that work for people and not for the banks," As the interviewer commented, "One thing he's really got going for him is ... that in Spain they can kick you out of the house and you still keep paying the mortgage. It's a recourse loan".

The other big issue is austerity. Spain still runs a large fiscal deficit - 5.6% of GDP in 2014 - the largest in the Euro Area. At first glance, with so many elections taking place it doesn't seem likely this will come down that much this year, and in 2016 it is hard to imagine there won't be a parliamentary majority in favour of prioritizing bringing down unemployment over reducing the deficit, making some sort of clash with the EU commission not improbable. Nevertheless, as long as ECB QE stays in place investors are hardly going to worry too much so yields wouldn't necessarily be affected. But what if the ECB wanted to taper?